What To Consider Before Receiving Your Salary in Bitcoin

Table of Contents

As the hype behind Bitcoin settles, and the value begins to stabilize, the public has begun to look at cryptocurrency through a more practical lens.

For what can this be used on a day-to-day basis? How will this function as a viable investment? Can I get my next coffee with Bitcoin?

Amongst such questions, there’s a prominent one that is being asked amongst employees: should I receive all or some of my salary through cryptocurrency?

Image: Marco Verch

Now, this question has been asked for a while. In the beginning, it was asked only by crypto startup employees. Coinbase even used to pay its employees – all six in 2013 – entirely through Bitcoin.

Fast-forward to today and you’ll see a trend in articles popping up asking serious questions about options for getting paid in crypto.

Since this is becoming a prominent conversation in the community, we think it’s important to step back and assess the pros and cons of what this all adds up to. Of course, for full disclosure, we’re a company that is directly involved with combining payroll with crypto options for our clients.

So let’s jump into it. What are the pros and cons of getting partially paid in crypto?

Pros

Privacy

When you’re using Bitcoin, your identity is protected.

Well, not 100 percent: You’re not anonymous nor are you untraceable. But what we mean here is that the worries typically associated with credit card use and identity theft are lessened dramatically. You can even go so far as to send payments while keeping your identity hidden, as long as you follow responsible security practices. This makes it an attractive option for employees who're looking to diversify their salary options.

Image: Pixabay

When you consider the very nature of Bitcoin, it’s easy to understand why it’s a prime choice for those looking to retain privacy. In the traditional economic system, an individual must work with a third party to manage their finances. A third party means a whole new dimension of security liabilities. However, crypto eliminates that third party. Your currency is managed by you and only you.

As aforementioned, Bitcoin is not anonymous, but it does empower anonymity. Through pseudonyms and the right steps taken, using Bitcoin can be a way for users to engage in an entirely new model of privacy.

Payment Efficiency

Another great reason for employees to consider a crypto salary? It’s a damn efficient form of currency.

For example, Bitcoin handles international payments with ease. These transactions are fast and not dependent upon any sort of bank or limit. So to receive some of your wage in Bitcoin is to have a small pocket of flexible, fast currency.

Image: Pixabay

Efficiency also relates to fees.

Think about it: when you’re dealing with banks, wiring fees can be as expensive as $30 take as long as 3 or 5 days. With Bitcoin, we’re talking fees of around $0.30 and times that rarely exceed 30 minutes. Not to mention that fees have nothing to do with the actual amount transferred, as this is usually related to the wallet itself. This puts you in greater control of the fees on transactions. You can always choose higher fees as well if you’re looking to get your Bitcoin transferred quicker.

Getting paid in crypto means you’re getting paid in something that is dependable, fast, and easy to use.

Financial Liberation

Perhaps one of the biggest upsides to having a part of your salary partially transferred into Bitcoin is that you’re being supplied with a currency that is made for consumer freedom.

The value comes from being your own bank and controlling your own private keys. No one can keep you from spending your money and, even better, there’s no entity waiting to freeze your account. Even better, you’re not stuck in the neverending cycle of increasing the money supply via printing and the devaluation that comes about as a part of too much money in circulation.

But if you’re a Westerner who just read that last statement, you may be hard pressed to see the issue. But this certainly isn’t the case for places like Venezuela.

Image: Diariocritico de Venezuela

During times of extreme economic collapse, crypto can provide much-needed respite. Throughout the Venezuelan financial crisis, citizens have quite literally depended on Bitcoin to partake in a currency exchange system that has significant value. This trend has grown outward to other areas in South America as people begin to realize that Bitcoin and crypto are an important way to enter a new realm of financial freedom; away from a constrained system of government and regulation.

You can think of Bitcoin as a form of digital gold that provides freedom from the fiat currency that relies on little more than trusting in the government. You can’t get more liberating than that.

Cons

Companies Just Aren’t Doing It

As an employee seeking out this option, you’ll have trouble even finding a company that offers this option. That, we feel, is a con in itself. If you’re looking to get paid in crypto, be prepared for a tough search. Maybe you do find one, but maybe it’s not a company you’re interested in working for. Then what?

The reality is that providing a partial crypto salary is complicated for payroll specialists. As a result, many companies are uninterested in the hassle.

Image: JD Lasica

But, nonetheless, the conversation is being had. Square CEO Jack Dorsey recently revealed plans to double down on their crypto initiatives by hiring more engineers to work in that space. He said that the option to be paid in Bitcoin would be available to them. That’s a start, but we have a long way to go before this becomes mainstream.

It’s a Tax Headache

Another unfortunate reality of getting paid fully or partially in Bitcoin or crypto is that they provides a whole new dimension of tax navigation, which is honestly the last thing many of us need.

Image: Pexels

Crypto taxes have proved to be a real challenge for newcomers, especially considering that crypto taxes are much different than your fiat dealings. When it comes to the IRS, you want to do things right, and this may end up being too much of a hassle for those of you out there who want a piece of crypto from your salary.

Public Keys are Stressful

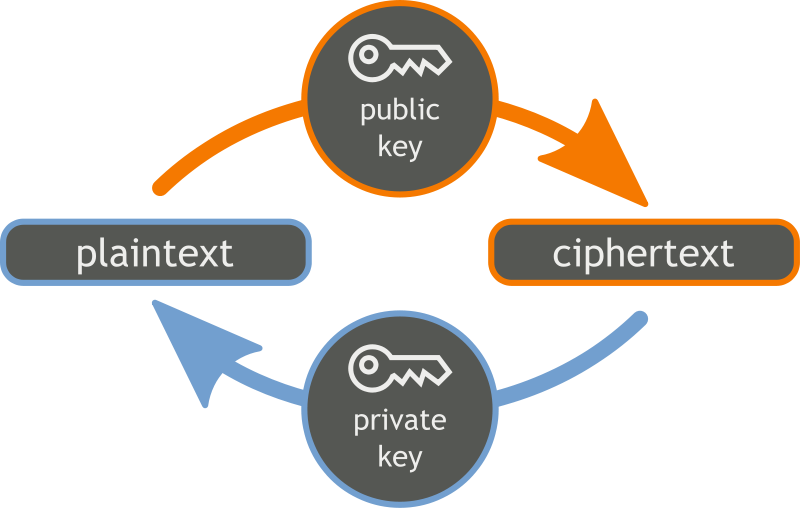

Ok, not really stressful as a general concept, but there’s a new level of liability that appears when there’s the expectation of having your public key shared with your employer.

Basically, when you send crypto to someone, you do so through their public key. Since this is the case, an employer must know your public key in order to compensate you with the crypto of your choice. This creates two problems

Image: Wikipedia

First, it’s entirely possible that you don’t even want your employer to know your key. After all, it’s sensitive information.

Second, they can just royally screw up the process and send your precious 0.04 BTC to the wrong key – they could be as little as one letter off – which would result in you losing that amount forever.

Bottom Line

The pros and cons go on and on, but the points made above are the ones that we feel are the most pertinent. Do research yourself and make an informed decision on whether or not a partial Bitcoin salary would work for you.

As a company that specializes in offering crypto-related payroll solutions for employers and employees, we’d love for you to consider us as you weigh the possibility of full or partial crypto salary. Many of the cons you see above – and others – can be rectified through our services.